- Blog

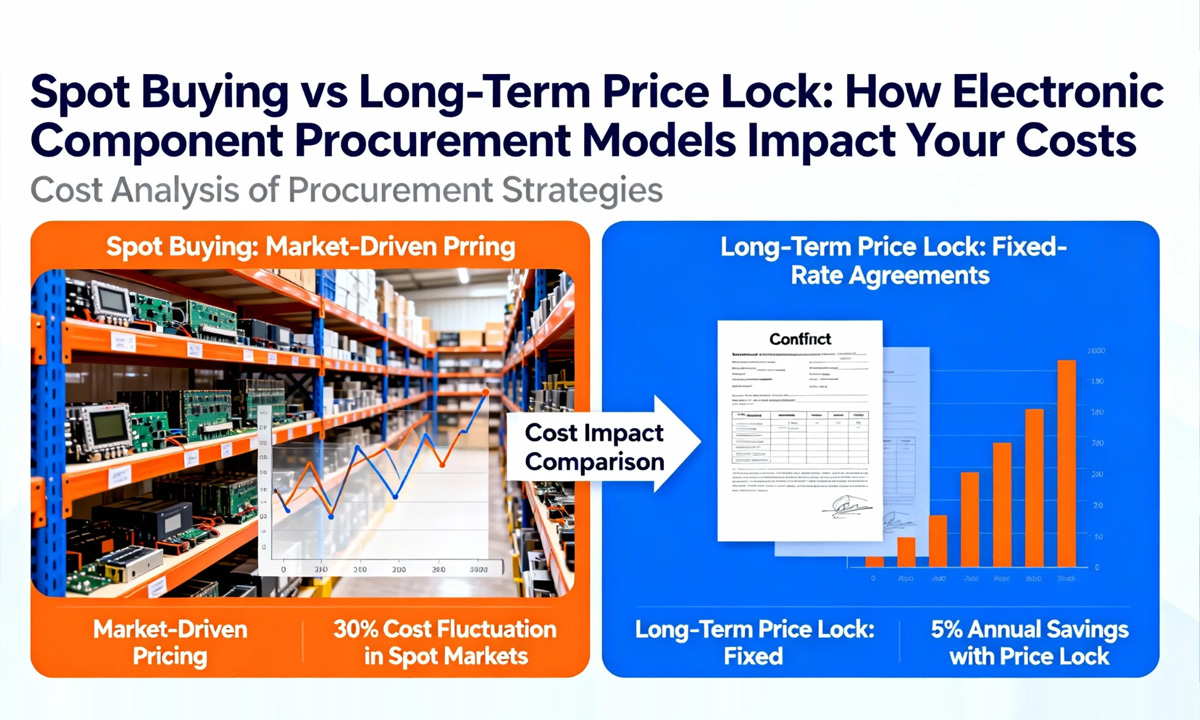

Spot Buying vs Long-Term Price Lock: How Electronic Component Procurement Models Impact Your Costs

- By tian81259@gmail.com

In electronic manufacturing, component cost is never just about the unit price on a quote. The way you buy – spot purchases vs. long-term price-lock agreements – can easily decide whether your BOM cost is stable or constantly blowing up your budget.

This article breaks down how these two procurement models work, how they influence total cost, and how to build a hybrid strategy that fits your business.

What is Spot Buying in Electronic Components?

Spot buying (also called “spot purchasing” or “short-term buying”) means you purchase components based on current demand and current market prices. There’s no long-term contractual commitment for price or volume.

Typical characteristics:

- Short horizon – you buy for one batch, one month, or one project phase.

- Market-driven prices – heavily affected by supply–demand, lead times, and shortages.

- Flexible quantities – you can quickly adjust order volume if demand changes.

- Fast reaction – useful when you need to respond to urgent orders or design changes.

Common use cases:

- NPI (New Product Introduction) and prototyping

- Uncertain demand or short product lifecycles

- Niche or hard-to-forecast components

What is Long-Term Price Lock (Long-Term Agreement, LTA)?

Long-term price lock means you sign an agreement with a distributor or manufacturer to fix (or cap) component prices over a defined period – often 6–24 months – based on a committed or forecasted volume.

Typical characteristics:

- Stable prices – unit price is fixed or within a narrow adjustment band.

- Volume commitment – annual usage (AU) or minimum order quantities are agreed in advance.

- Reserved capacity – supplier allocates production or inventory for you.

- Stronger partnership – you often get better support, allocation priority, and payment terms.

Common use cases:

- Mass production with stable or predictable demand

- High-value ICs, power devices, or parts that can stop your line

- Strategic projects where cost stability is critical (EV chargers, industrial power, etc.)

How Procurement Models Really Impact Your Cost

1. Unit Price vs. Market Volatility

Spot buying

- Can be cheaper when the market is soft and prices are dropping.

- Can be dramatically more expensive in shortage cycles (allocation, long lead times, sudden price hikes).

Long-term price lock

- May not be the lowest price on day one, but protects you when the market goes up.

- Offers more predictable costing for long-term quotes and customer contracts.

Key takeaway:

If your BOM contains price-sensitive items (MCUs, MOSFETs, IGBTs, power management ICs), a long-term price lock can prevent “surprise” cost spikes that destroy your margins.

2. Inventory and Cash-Flow Cost

Spot buying

- You can buy “just enough”, reducing inventory holding cost.

- But if you try to “buy low” in bulk when the market price drops, you may over-stock and freeze cash.

Long-term price lock

- Because the future price is stable, you don’t need to hoard stock just to hedge price risk.

- You can align deliveries with your MRP/production plan and keep inventory turns healthy.

Hidden cost angle:

The cheapest unit price is meaningless if your warehouse is full of slow-moving stock tying up cash and increasing risk of obsolescence.

3. Risk of Line-Down and Expedite Fees

When components are not available on time, the real cost is not just the extra you pay to brokers – it’s also:

- Production line stoppage

- Overtime for urgent changeovers

- Late delivery penalties to your customers

Spot buying increases this risk when supply is tight: if you only start looking for parts when you receive a rush order, you may end up paying high expedite and broker fees.

Long-term price lock usually comes with allocation and priority in tight markets, significantly reducing:

- Line-down risk

- Last-minute logistics premiums

- Expensive emergency substitutions

4. Cost of Engineering Changes and Obsolescence

In electronics, designs evolve quickly: new IC generations, package changes, discontinuations.

- With spot buying, you are more flexible: if a component is replaced, you don’t hold large unused stock under contract.

- With a long-term agreement, you must manage the balance between committed volume and real consumption. Poor forecasting can create excess inventory when designs change.

Best practice is to clarify in your LTA:

- EOL (end-of-life) handling

- Last-time buy rules

- Flexibility bands for volume (e.g. ±20% of forecast)

5. Total Cost of Ownership (TCO), Not Just Price

When you compare spot vs long-term procurement, include:

- Unit price (with and without contract)

- Inventory cost (carrying cost, warehouse, insurance)

- Logistics (standard vs. urgent shipments)

- Risk cost (line-down probability, broker premiums)

- Internal admin cost (RFQs, approvals, frequent supplier switching)

Often, a slightly higher contracted unit price still wins when you factor in fewer emergencies, more stable scheduling, and lower admin workload.

When Spot Buying Makes More Sense

You don’t want to lock everything into long-term contracts. Spot buying is often better for:

- Early-stage products

- Designs are not frozen; BOM may change quickly.

- Demand is uncertain; you may still adjust features or cancel the project.

- Low-value, truly commodity items

- Generic resistors, simple connectors, common passives where price fluctuation is minor and new alternatives are easy to qualify.

- Niche or experimental components

- Low volumes where setting up a contract is not worth the effort.

Spot buying here keeps you agile and avoids being locked into commitments that don’t match reality.

When Long-Term Price Lock is the Better Choice

Long-term agreements usually create value for:

- High-impact components

- Microcontrollers, power MOSFETs/IGBTs, driver ICs, high-value MLCCs – parts that can stop your entire line.

- Mature, stable products

- BOM is frozen, and you can forecast volume 6–24 months ahead with reasonable accuracy.

- Strategic suppliers

- Partners that support your quality, delivery, and engineering needs. Price stability reinforces long-term cooperation.

For a structured view of how to design your process from forecasting to supplier selection, you can refer to our electronic component procurement guide

Building a Hybrid Strategy: The 70/20/10 Model

A practical approach many companies use is a hybrid model rather than “either–or”:

- 70% of spend: long-term price-locked contracts for key, high-impact, stable-demand components.

- 20% of spend: flexible agreements (price review windows, partial locks) for parts with moderate volatility or evolving demand.

- 10% of spend: pure spot buying for prototypes, trials, and low-risk items.

This mix gives you:

- Cost stability on what matters most

- Flexibility where engineering and demand are still changing

- Higher bargaining power with strategic suppliers (because you commit volume)

Practical Steps to Optimize Your Procurement Model

- Segment your BOM

Classify components by value, risk, and demand predictability. Your microcontroller and your 1/4W resistor should not follow the same buying strategy. - Analyze past price and demand data

Look at 12–24 months of usage and price history. Identify which parts caused the biggest cost swings or line-down risks. - Talk openly with suppliers

- Ask about their capacity, lead-time trends, and risk items.

- Explore options: full price lock, price caps, indexed pricing, or volume-based rebates.

- Align procurement with engineering and production

- Freeze BOMs earlier for high-impact parts going into LTA.

- Coordinate design changes with contract terms to avoid write-offs.

- Invest in process and automation

Stable procurement is easier when your internal processes are efficient. For example, when you move into mass production, using dedicated equipment like a resistor lead forming machine helps standardize your component preparation, reduce scrap, and make your real consumption more predictable – which in turn supports better long-term pricing with suppliers.

Conclusion

Spot buying and long-term price-lock agreements are not competitors – they are tools.

- Spot buying offers flexibility and is ideal for early-stage, low-risk, or unpredictable items.

- Long-term price locks offer stability and are essential for high-impact components and mature, high-volume products.

When you evaluate procurement models from a total-cost perspective – including inventory, risk, and process costs – a thoughtful hybrid strategy will almost always beat a purely “cheap-on-paper” spot-buying approach.

By segmenting your BOM, analyzing real data, and aligning procurement with engineering and production, you can turn your purchasing model into a true competitive advantage, not just a monthly firefight over unit prices.

Related Posts

20 Years of Expertise, Trusted by Clients Worldwide

The Preferred Choice of Foxconn, BYD, and Huawei